Over £100m still reserved by Wirral Council, up from £67m in 2020

Wirral Council published its accounts for the year ending March 2022 a few weeks ago. What is revealed?

£104.9 million are still held in earmarked reserves

Reserves have been used to keep frontline services open

Contingency money should be used to keep libraries open as Warm Hubs

Capitalisation loans have already cost the Council £346,000

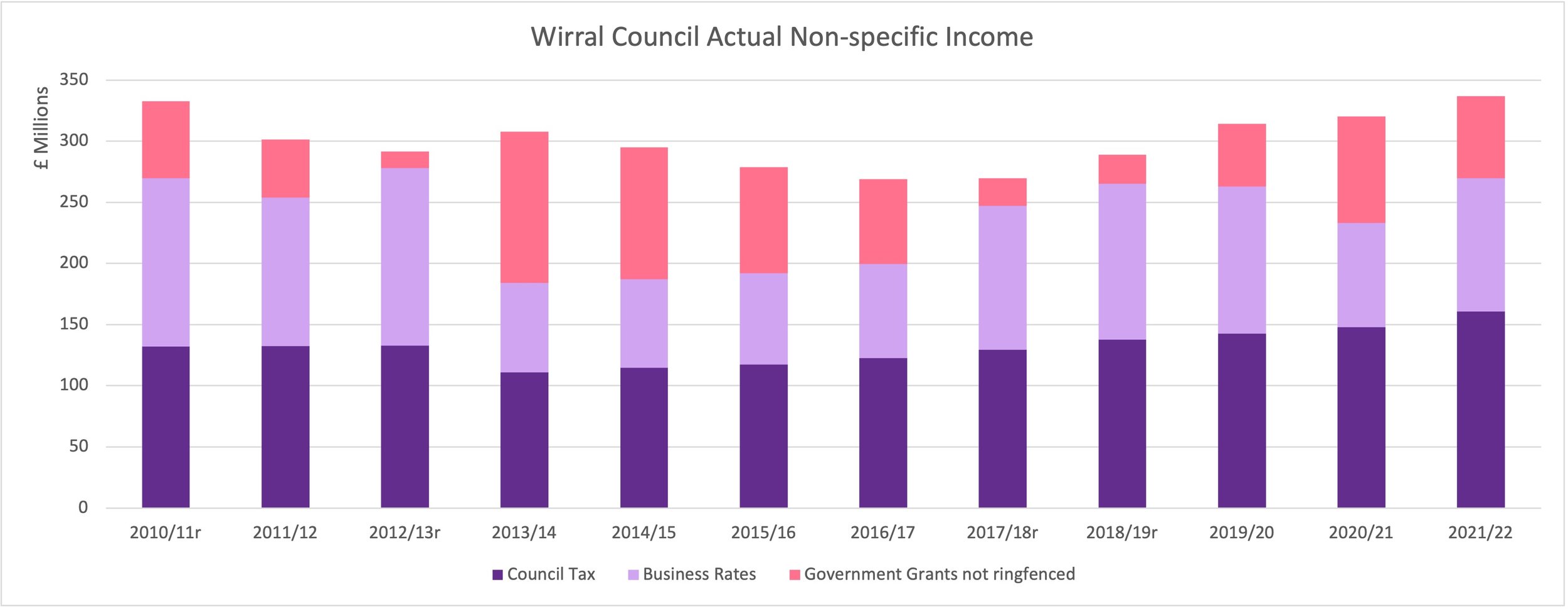

Actual income was £6.6m higher than the £330 million budget set in March 2021

Council income has increased every year since 2017

Actual expenditure was £331 million

1. £104.9 million are still held in earmarked reserves

This is almost £10 million down from last year’s all time high of £114.6 million. The General Fund balance stayed the same for the fourth year running, at £10.7m.

Inflation is reducing the value of Council reserves every year, and by at least 10% this year alone. In other words, the earmarked reserves are worth over £10 million less in today’s money, than they were a year ago. And General Fund balances are worth over £1 million less.

2. Reserves have been used to keep frontline services open

Last February, I argued there was no need for cuts to libraries, swimming pools and golf courses. Out of £117 million of ear-marked reserves, there were £27 million that were legal to re-purpose.

Indeed, the Council budget of £330 million passed in February this year used over £4 million of earmarked reserves. £2.5 million was moved into General Fund balances, £0.5 million for Childrens’ services, £0.5 million for Leisure and another £0.6 million went into future waste levy charges.

3. Contingency funds could and should be used to keep libraries open as Warm Hubs

Last February, I laid out credible, legal proposals that showed a No Cuts Balances Budget was possible. Some of my ideas were adopted in the final budget. But Labour and Conservative councillors voted together to push through £716,000 of cuts to frontline services regardless. Green and LibDem councillors voted against that particular budget. The budget included an overly prudent contingency fund of £3 million for unachieved savings.

We have been proved right. Reports to the end of June shows only £850,000 of savings are likely to not be achieved. £580,000 as a result of delays to Community Asset Transfer agreements plus £270,000 because proposed new car parking charges have not yet been decided. This leaves £2.15m in the contingency fund reserve.

Green councillors like myself believe this contingency fund should partly be used to keep libraries open longer to the public. In this forthcoming cold winter, we need ‘Warm Hubs’ more than ever, for people in every community to keep warm, use wifi, read books and connect with other people.

A longer transition of libraries and community hubs to Community Asset Transfer would also help address delays to agreements between the Council and not-for-profit organisations. In my ward in particular, Bromborough library needs to stay open. Our library is within Bromborough Civic Centre which has not yet been put into scope of the Community Asset Transfer programme. Our community was promised in public committee that the Community Asset Transfer option for Bromborough Civic Centre will be considered by the relevant council committee in September. This promise is being broken.

4. Capitalisation loans have already cost the Council £346,000

Its doubtful that these loans should have been requested in the first place. The loans total £12.1m - from £6.25m borrowed in 20/21 and £5.85m in 21/22. With different leadership, these amounts could have covered by using more reserves, selling unused assets (now planned), or by bringing forward acceptable savings. These suggestions were ignored in favour of bringing in external unaccountable intervention.

3% interest and repayments on the first loan already cost Wirral Council £202,000 last year. This year, in addition to repayments on the first loan, there will be a similar amount for the second loan too.

Requesting the loans brought an additional Director of Finance. The additional senior manager alone has cost the Council at least £129,500, so far.

The loans also came with an “Independent Panel” approved by the Conservative Minister for local government. Two members of the panel are charging £75 and £122 per hour. Payments have been of £16,500, down down from a budget of £30,000.

So the first capitalisation loan has already cost the Council at least £346,000 so far. Money that could have been spent on frontline services instead.

5. Actual income was £6.6m higher than the £330m budget set in March 2021

The accounts for 2021/22 show actual non-ringfenced income was £337.0m. This continues the unhelpful pattern of under-forecasting Council income each year.

6. Council income has increased every year since 2017

However, these income figures do not take into account inflation. Inflation means there have been real-terms cuts to Council income since 2010.

7. Actual expenditure was £331 million

Actual expenditure was £331.0 million, of which £105.5m on Adult and Social Care, £92.8m on Children’s Services and £132.7m on other services.

Related articles

This article continues a series of user-friendly guides to Wirral Council budget and accounts.

https://jobird.net/blog/another-wirral-is-possible

https://jobird.net/blog/a-no-cuts-balanced-budget-is-possible

https://jobird.net/blog/wirral-councils-income-under-forecast-by-10-271m-each-year

https://jobird.net/blog/cuts-to-council-services-are-a-political-choice

Coming soon: Executive pay